montana sales tax rate change

The Montana sales tax rate is currently. They are always kind and.

Nomad States The Latest On Sales Tax

The Montana sales tax rate is currently.

. The Call Center always does a good job helping when I call for assistance with my tax return. Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 69 to 675 in 2022 and. The minimum combined 2022 sales tax rate for Hamilton Montana is.

Montanas tax rate for a statewide sales tax is limited to 4 percent in the state constitution. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities. This is the total of state county and city sales tax rates.

Lockwood MT Sales Tax Rate. In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Combined Sales Tax Range.

Local Sales Tax Range. However the act imposed limitations on the states use of the funds. Montana received about 930 million in ARPA funds.

The County sales tax rate is. The County sales tax rate is. Montana Sales Tax Ranges.

There is 0 additional tax districts that applies to some areas geographically within Saltese. Montana State Montana Sales Tax Exemptions. Instead of the rates shown for the Mineral tax region.

Since there is no state sales tax you do not have to worry about paying any taxes on your vehicle no matter how you purchase the car. The December 2020 total local sales tax rate was also 0000. Livingston MT Sales Tax Rate.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. It specifically prohibits a state from using the funds to offset a. Tax rates last updated in August 2022 Note.

There is 0 additional tax districts that applies to some areas geographically within Ethridge. Department of Revenue Call Center. 513 rows February 2022 512 changes November 2021 86 changes Over the past year there have been 982 local sales tax rate changes in states cities and counties across the United.

Tax rates last updated in August 2022 Note. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard. For instance lets say that you want to.

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. The montana state sales tax rate is 0 and the average mt sales tax after local surtaxes is 0. The current total local sales tax rate in Big Sky MT is 0000.

Print This Table Next Table starting at 4780 Price Tax. Instead of the rates shown for the Toole tax region. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Roy Montana is. Lewistown MT Sales Tax Rate. Laurel MT Sales Tax Rate.

The County sales tax. Base State Sales Tax Rate. Gianforte signed another companion bill.

The montana state sales tax rate is 0 and the. This was the situation faced by a louisiana taxpayer. 2022 Montana Sales Tax Table.

The state sales tax rate in Montana MT is currently 0.

Ci 121 Montana S Big Property Tax Initiative Explained

How To Charge Sales Tax In The Us 2022

Updated State And Local Option Sales Tax Tax Foundation

U S States With No Sales Tax Taxjar

State Income Tax Rates Highest Lowest 2021 Changes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

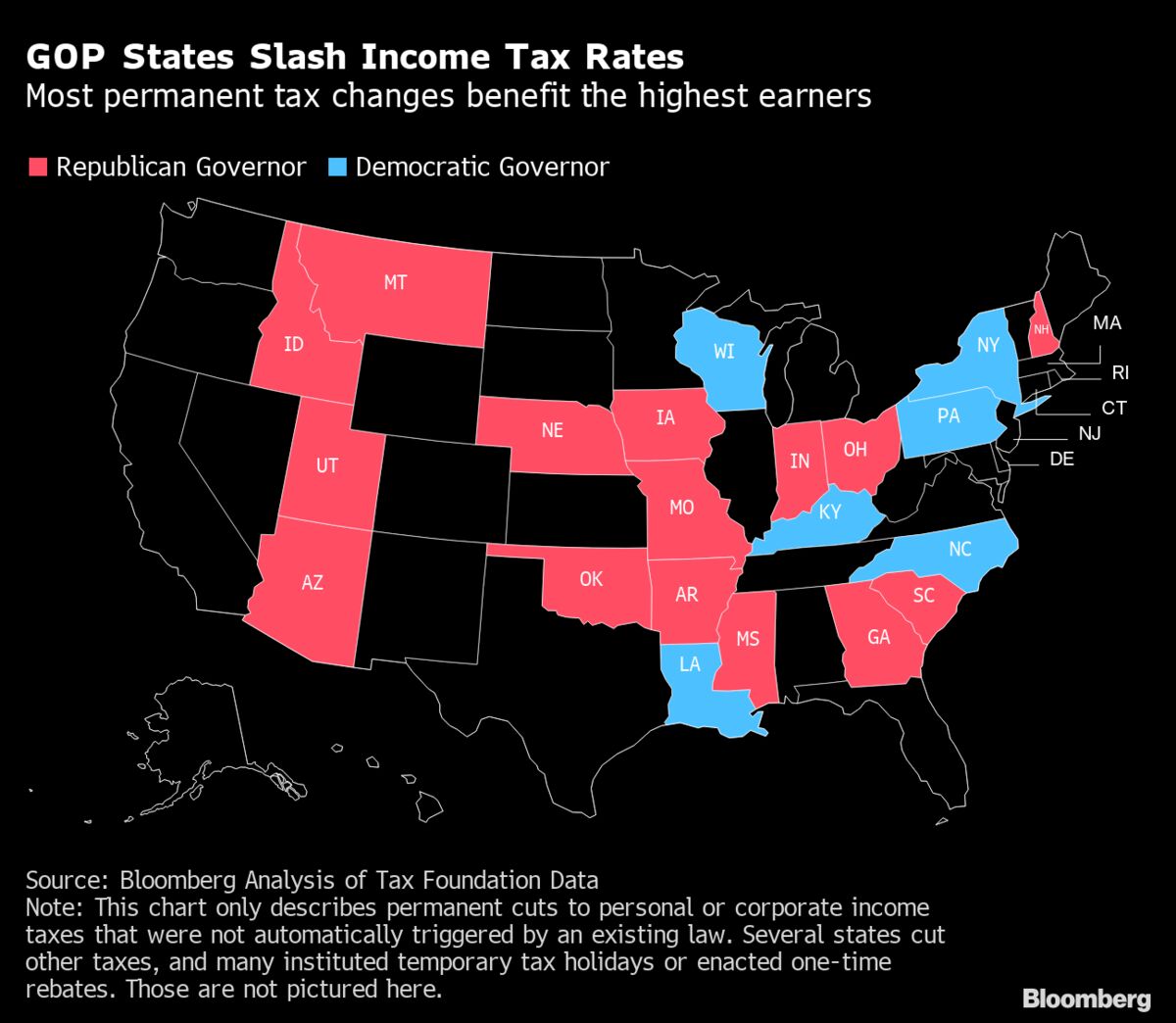

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

States Without Sales Tax Article

Monday Map State And Local Sales Tax Rates As Of July 1 2012 Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate